Life sciences among top investment sectors during COVID

Angel investment in the life sciences sector is still going strong during COVID-19, a recent survey by the British Business Bank and the UKBAA reveals.

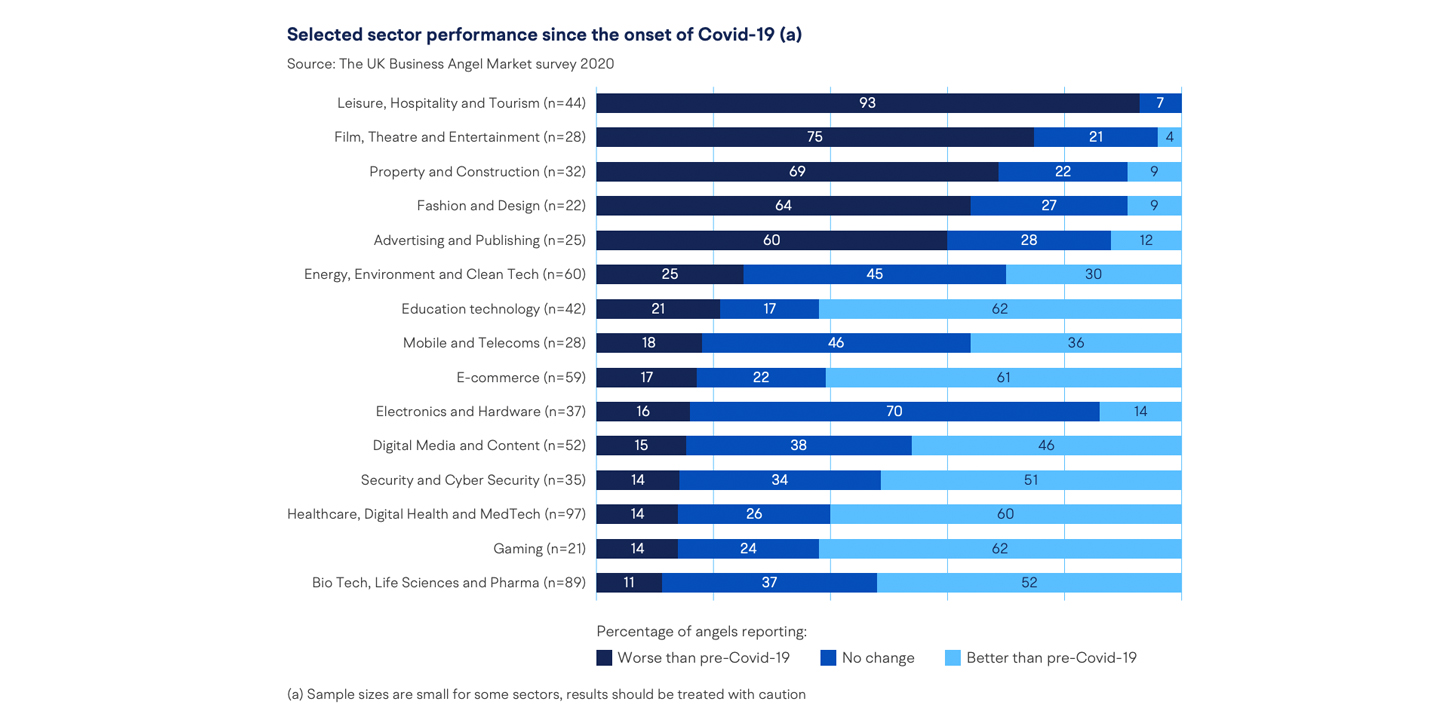

While portfolio performance has varied across sectors, life sciences has performed considerably better than other industries.

Sectors that have provided essentials, entertainment and educational services during lockdown have thrived during the first 2 quarters of 2020, the survey highlights.

Respondents cite digital health, medtech, edtech, ecommerce, gaming, life sciences and pharmaceuticals as their best performing investments.

According to a report by Beauhurst, half of all life sciences companies tracked this year have received innovation grants, and 64% have taken on investors to grow their business.

The findings come at a time when over 50% of UK angel investors report being negatively affected by the effects of the pandemic.

Portfolio performance during lockdown

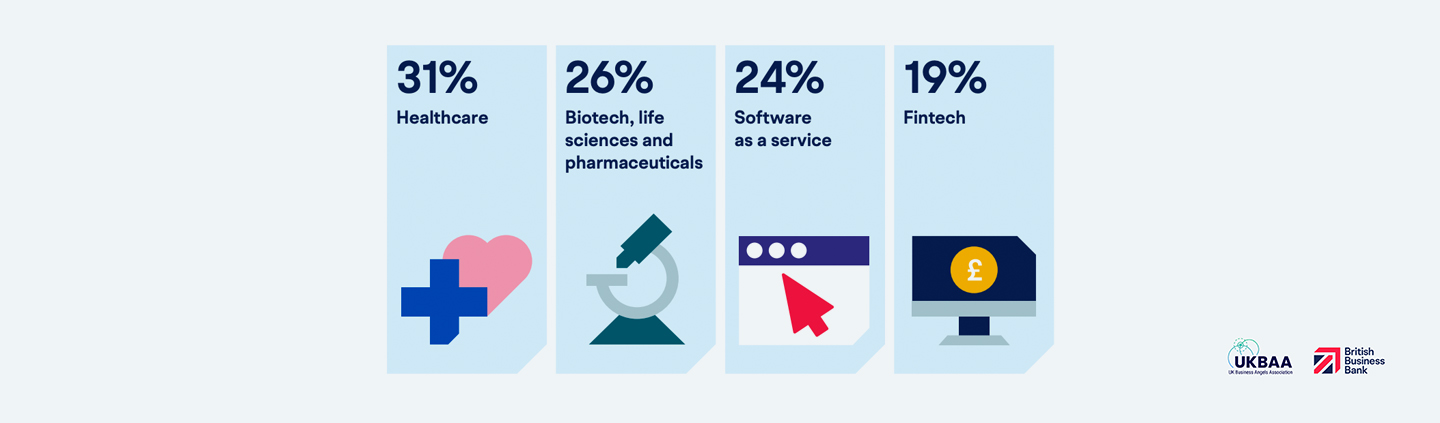

Life sciences has ranked among angel investors’ most favoured sectors during COVID 19, alongside healthcare, biotech and pharma, SaaS and fintech.

Most survey respondents cite diminished investment capacity and the need to support existing businesses in their portfolio during the crisis as deterrents from growing their portfolio during the pandemic. Out of all angels surveyed, only 9% report a positive impact on their portfolio during COVID.

The report reveals that life sciences is amongst a small number of sectors that have been performing better since the onset of Covid-19.

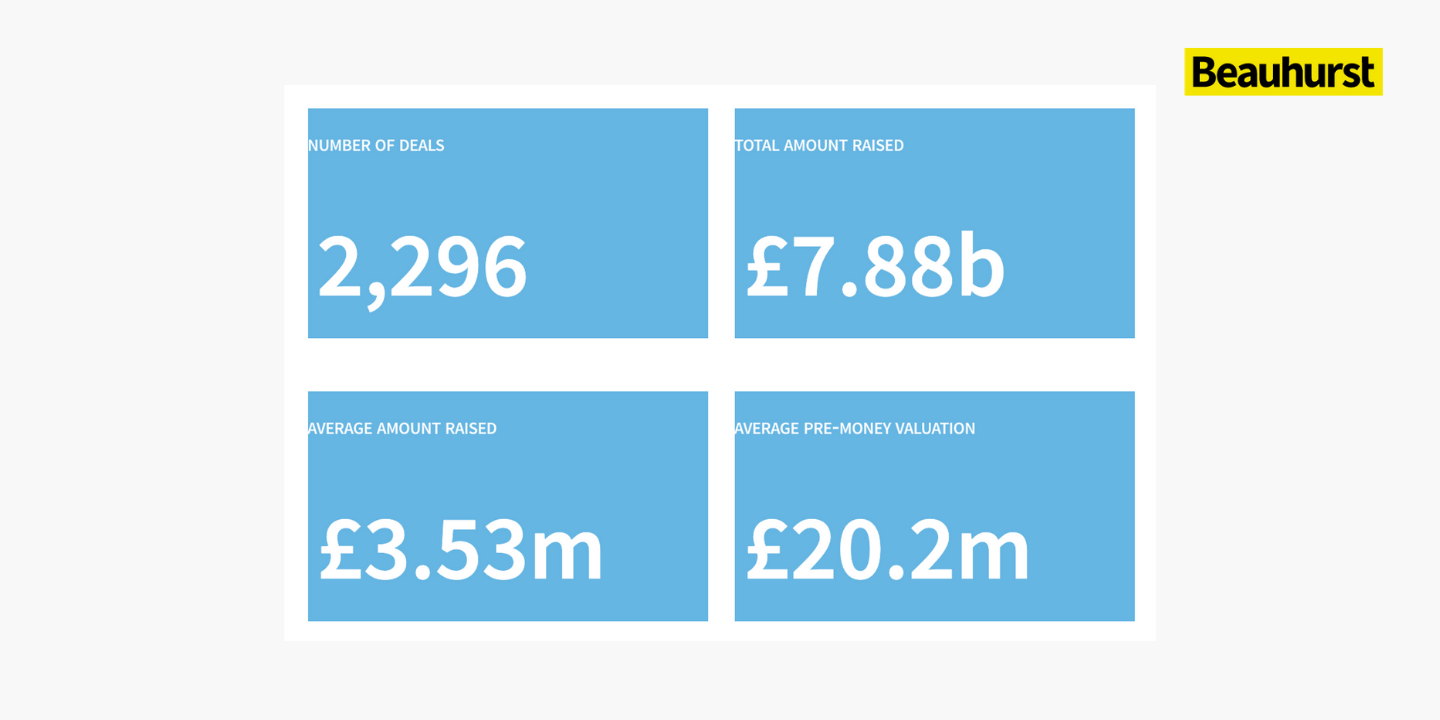

Number of fundraisings and total amount raised in 2020

Companies involved in drug development, biotech, and biopharmaceutical R&D have attracted the most early-stage investment in the sector through the lockdown.

Beauhurst highlights over 2000 deals made in 2020, totaling almost £8B in funding at valuations of around £20m on average. Average investment clocks in at £3.5m, significantly higher than industry averages of £1.97m.

Notable rounds include Oxford Nanopore Technologies receiving £84.4m in October, F2G with a round of $60.8m in August and Cerevance with $45m in April.

Oxford Nanopore develops DNA/RNA sequencing technology, while F2G has raised investment for clinical trials to develop products that treat life-threatening fungal diseases. Cerevance develops software and therapies for the treatment of nervous system diseases like Alzheimer.

COVID Impact

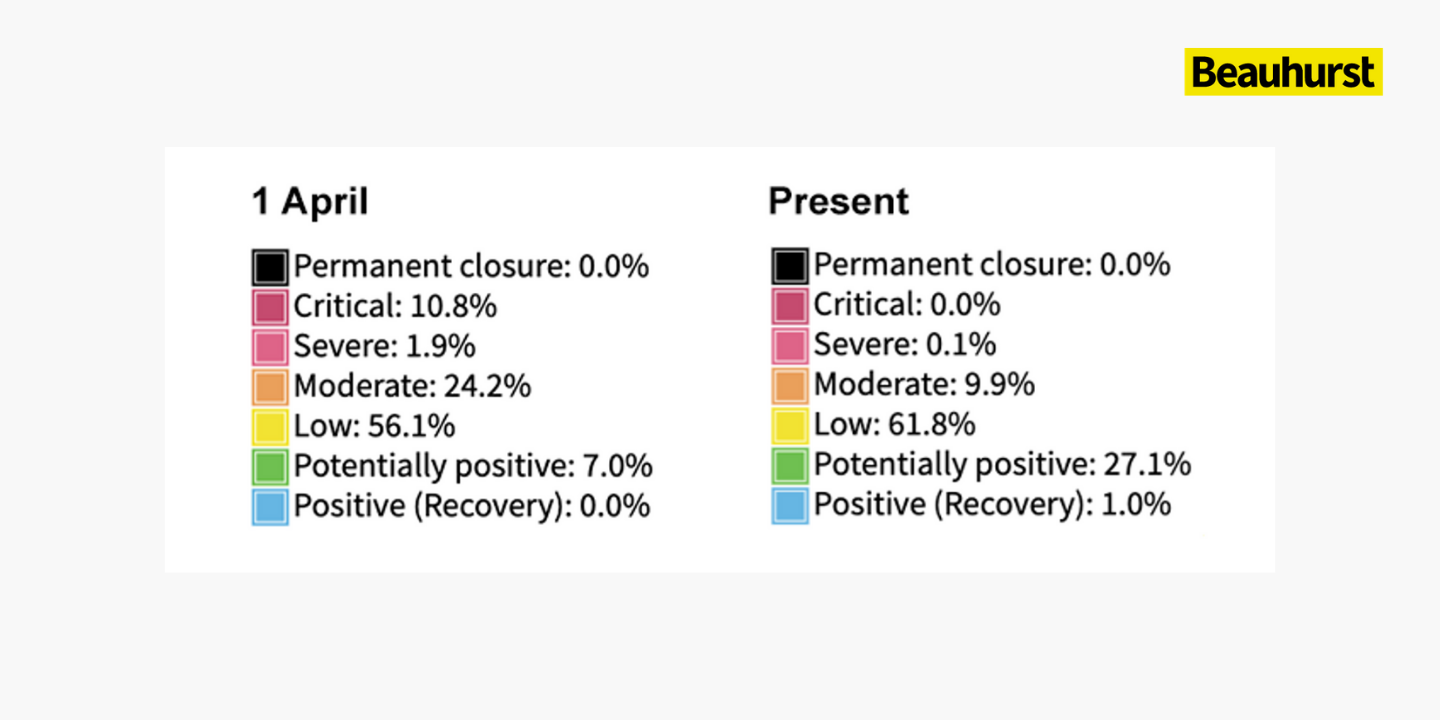

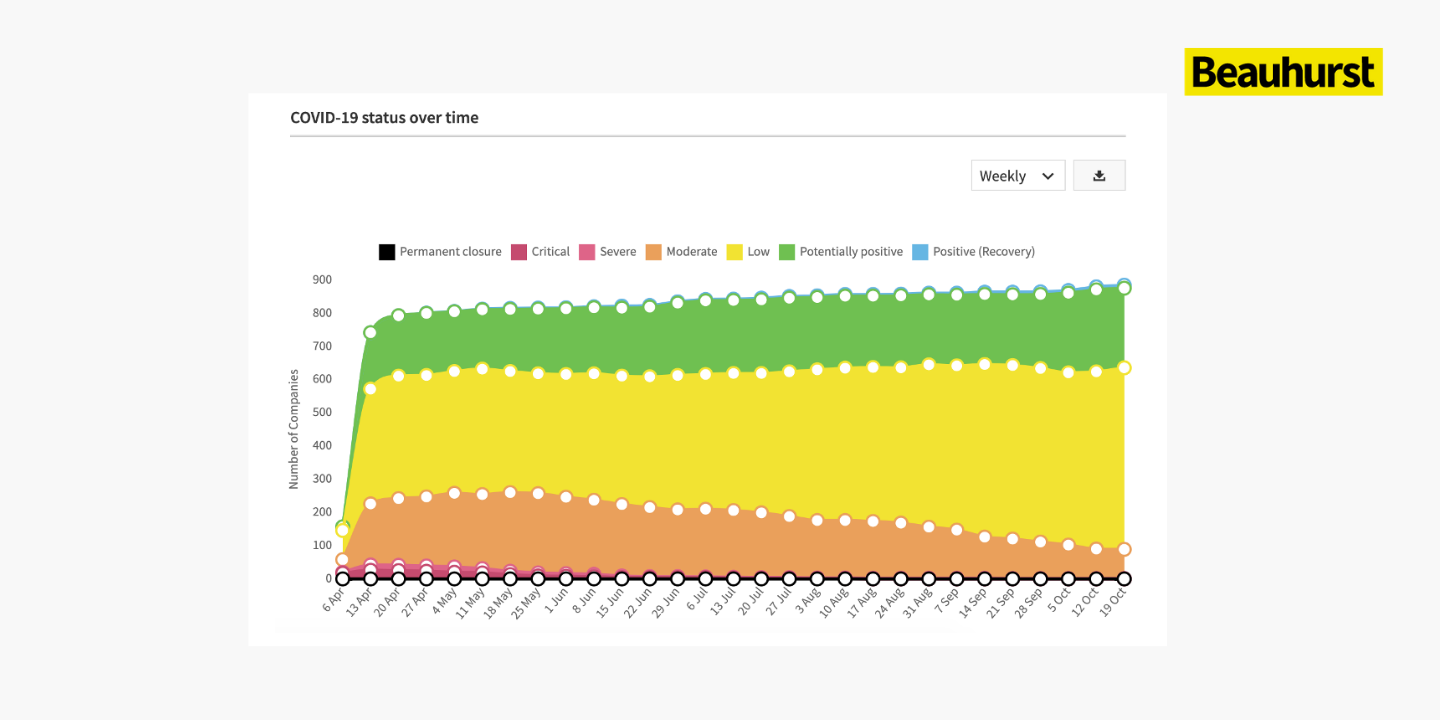

Only 0.1% of UK life sciences companies are now at serious risk of closing down operations due to COVID 19, Beauhurst reports.

The platform outlines that 0.1% of companies’ COVID status is marked as severe while none are in critical state. The metrics mark a noticeable improvement from 10.8% of companies being in critical state and 1.9% facing severe disruption in April.

‘Severe’ status is defined by serious disruption to a company’s ability to operate while critical state is a reliable indicator of a company’s impending inability to continue operating.

Several businesses marked as risking closure in April have now been upgraded to a low-risk status, the report reveals.

While 70% of companies are still experiencing low or moderate risk of closing down, more than 27% are showing signs of recovery and are experiencing a positive impact due to the current crisis.

Life sciences companies need significantly more resources and capital for R&D in order to grow. Envestors partner OBN Ventures supports early-stage life sciences businesses as they seek funding and gives investors access to high-quality opportunities through an FCA-approved digital investment platform.