Angel investors still active during COVID-19, British Business Bank report reveals

The UK early-stage investment market has yet to buckle under the pressure of COVID economic certainty, the British Business Bank’s 2020 UK Business Angels Market report reveals.

The report sheds light on how UK angel investment is faring during the pandemic, based on survey data gathered between April and July of 2020.

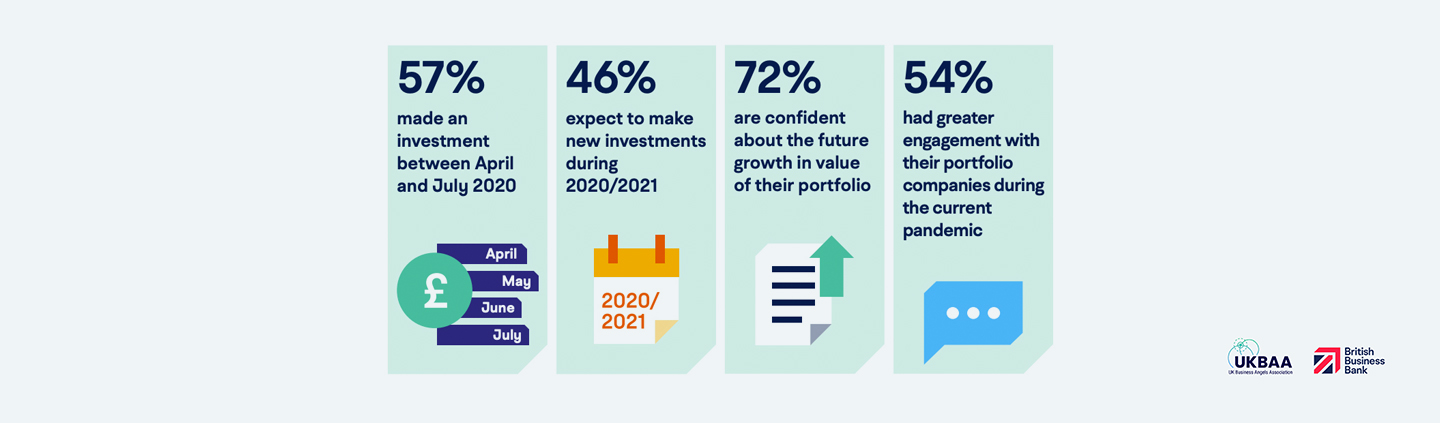

Over half of angels surveyed have made an investment since the start of the pandemic, and 46% will be adding companies to their portfolio by the end of the financial year.

According to the report, created in collaboration with the UKBAA, more than half have decided to support companies in their portfolio as they weather these challenging times.

While half of respondents reported being negatively impacted by COVID-19, almost 3 thirds are confident in the market recovering over the next 12 months.

Only 2 in 5 have said that the pandemic has not impacted their portfolio, while 1 in 10 saw a positive impact.

How angels are investing

While angels are still looking to invest, survey data suggests they are making fewer investments than before the crisis. Initial investments now sit at an average of £69k for Q1, down 31% from £100k, and £46k for Q2, down 34% from £70k.

More than half of respondents report increased follow-on investment, as they help companies in their portfolio stay afloat or reach growth milestones.

Most cite economic uncertainty and a preference for supporting companies in their portfolio as the main causes for deferring investment at this point.

A positive impact on the sectors they were investing in before the pandemic has been the main driver for new investment during Q2.

Portfolio performance so far

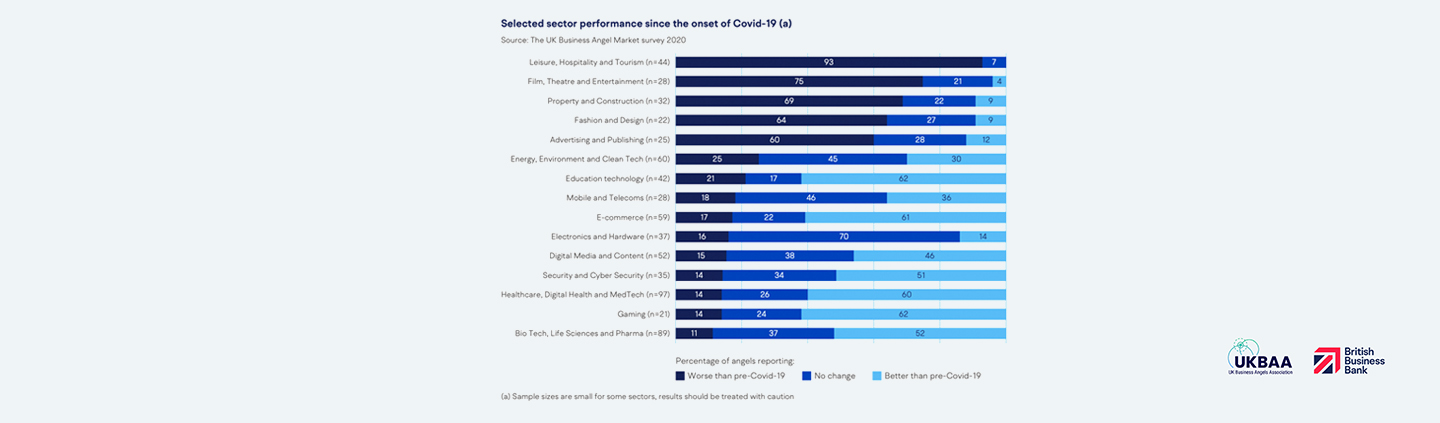

Portfolio performance per sector has varied, with few industries registering results that have stacked up to last year’s metrics.

Out of those, sectors that have provided essentials, entertainment and educational services during lockdown have thrived – Digital Health, MedTech, Education technology, E-commerce, Gaming, Life Sciences and Pharmaceuticals.

Top sectors

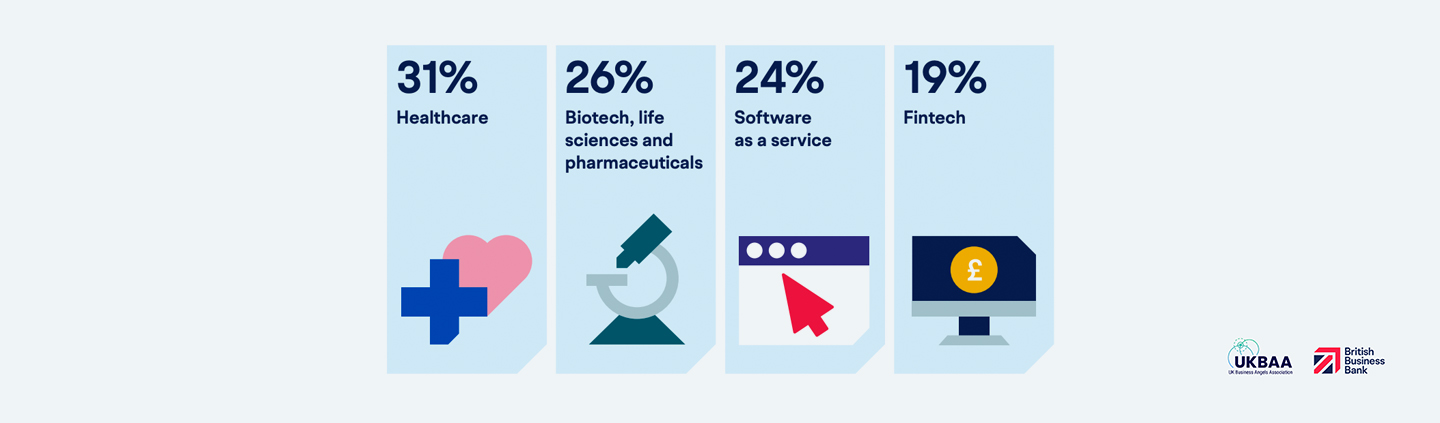

As expected, Healthcare, Digital Health and MedTech, BioTech, Life Sciences and Pharmaceuticals are the leading sectors in terms of investor engagement during the COVID-19 crisis.

Software as a Service and FinTech have fared well throughout the pandemic and are still attracting a large number of investors.

Exits

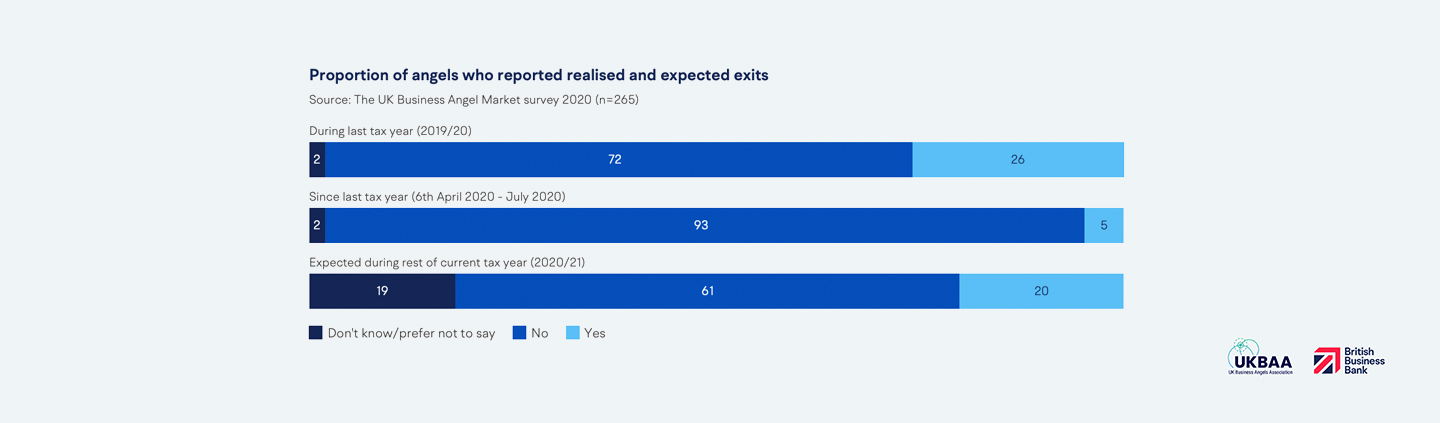

So far, few angel investors have reported exits in 2020, but among those three quarters have experienced positive outcomes, the British Business Bank survey highlights.

While the numbers don’t yet stack up to last year’s results, surveys were carried out in April and July and don’t yet account for the remainder of the financial year.

Challenges to investing

Economic uncertainty, the economic consequences of the virus and a lack of liquidity and less foreseeable opportunities for positive exits are the main challenges that the market faces, the report outlines.

Most angels surveyed are allocating less assets to angel investing – 13% compared to 17% in 2019/2020. However, around three quarters are optimistic about the market bouncing back within the next 12 months, and 46% are interested in backing new opportunities during the remainder of the financial year.

The findings show that angel investing is alive and well in the UK, and most investors are optimistic about future rounds. While economic uncertainty is taking a toll and it has affected the number of rounds closed so far, half of angels intend to keep building their portfolio in the next few months.